When Jim and Linda booked their long-awaited vacation, they did everything right. They saved for months, planned carefully, and even bought what they thought was “comprehensive” travel insurance.

But their dream trip turned into a financial nightmare that would haunt them for years.

It all started when Jim fell suddenly ill while abroad. What was supposed to be a minor checkup turned into an emergency hospital stay that stretched over several days. The couple thought their travel insurance would handle it — after all, that’s why they paid extra for it.

But when they returned home, they were greeted not with comfort, but with a $45,000 medical bill.

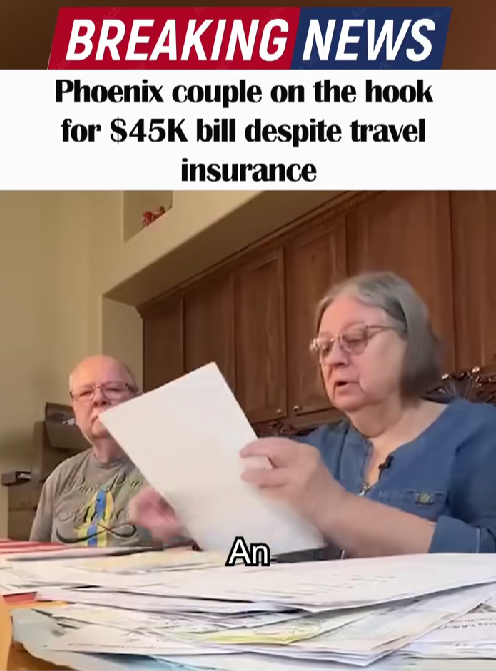

“I thought it was a mistake,” Linda said, shuffling through piles of papers. “We paid for coverage. We did everything right.”

It wasn’t a mistake. Hidden in the fine print of their policy was a clause that excluded certain emergency services outside of network hospitals. The language was confusing — even misleading — and by the time they realized what it meant, it was too late.

“They’ll advertise ‘worldwide coverage,’ but what they don’t tell you is how limited that coverage really is,” said a consumer rights expert who later reviewed their case.

The couple appealed, sent letters, made endless calls — but the insurance company refused to budge. “Every call felt like a dead end,” Jim said. “We were drowning in paperwork and stress.”

Their story, sadly, is far from unique. Each year, thousands of travelers find themselves facing crushing medical bills despite having travel insurance they believed would protect them.

Experts say the issue lies in the fine print — vague terms, exclusions, and confusing definitions that most people never fully understand.

“Insurance companies use complex language that even professionals struggle to interpret,” one travel advisor explained. “People assume ‘covered’ means safe. It doesn’t always.”

Jim and Linda’s story quickly spread online, striking a chord with travelers everywhere. It became a wake-up call about the importance of reading every detail, asking direct questions, and confirming what’s actually covered before traveling abroad.

Despite the heartbreak, Linda says she hopes their experience can help others avoid the same trap.

“If our story saves even one person from going through this,” she said, “then it’s worth sharing.”

Now, consumer advocacy groups are pushing for reforms that require insurance providers to simplify their language and clearly list exclusions — in plain English, not legal jargon.

The couple, meanwhile, continues to fight for fairness while warning others:

“Don’t trust the headline on the policy — read the fine print that could change your life.”

Their story is a reminder that sometimes, the system designed to protect you can fail — but by speaking out, people like Jim and Linda are helping make sure it doesn’t happen to someone else.

Leave a Reply